Join customer-focused institutions transforming efficiency, customer experience, and risk management.

More accurate and compliant AI solutions to optimize your operations and customer experience in the era of AI.

Flexible solutions that seamlessly fit and adapt to your changing business conditions.

Transparent explanations of how AI “thinks” for most compliant solutions.No “black boxes”.

Flexible solutions that seamlessly fit and adapt to your changing business conditions.

Scales cost efficiently, securely, and in compliance with AI regulations, worldwide.

Boost Loyalty

Stay Head of Churn: Proactively engage customers at risk: in the right way, at the right time, and with the right offer.

Focus on Ideal Customers: Optimize your business by retaining and acquiring the most valuable customers.

Personalize Customer Experience: Understand customer behavior to tailor marketing and support strategies to individual customer needs.

Increase Satisfaction: Improve efficiencies and serve customers faster and more effectively.

Increase Customer Acquisition

Predict Deposits: Anticipate customer deposit behaviors to optimize liquidity management and enhance financial planning.

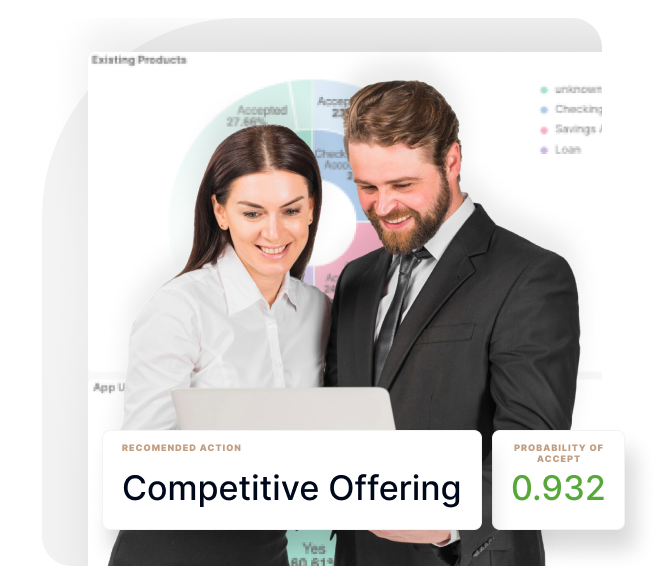

Personalize Offers: Identify and engage high-value customers to offer the right product at the right time.

Focus on Ideal Customers: Optimize your business by retaining and acquiring the most valuable customers.

Deepen Relationships: Utilize AI-driven insights to identify opportunities for additional products, boosting customer acquisition through targeted upsell and cross-sell strategies.

Stay Ahead of Fraud

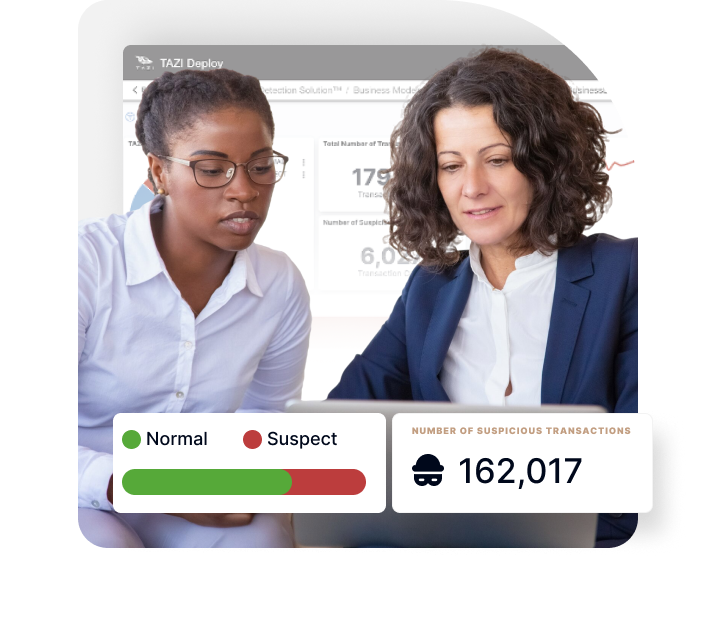

Detect in Real Time: Identify and prevent fraudulent activities as they happen.

Manage Risk: Use AI to assess and mitigate risks before they impact your business.

Automate Supervision: Leverage supervised models to adapt to new fraud tactics.

Why TAZI

%

higher

%

higher

%

more

higher

Your Client Data is Protected

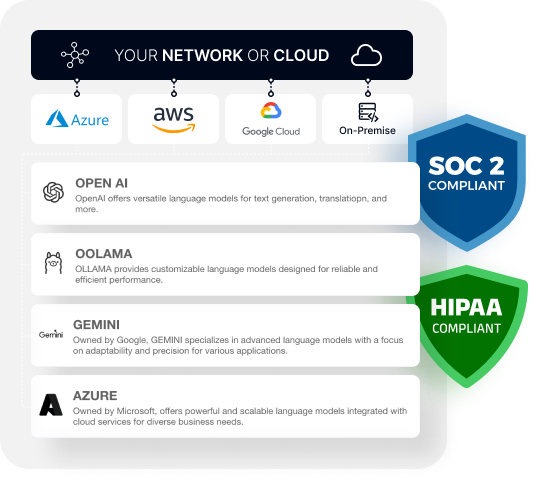

- Deployed in your environment, on-prem or cloud of your choice.

- Local (on-prem) LLM models within your firewall

- Granular user management and monitoring,

- Continuous documentation of data, AI models, performance and results.

Related Content

Experience the Future of

AI/GenAI with TAZI

✓ Showcase real-world applications and benefits.

✓ Provide a detailed platform walkthrough.

✓ Offer actionable insights for your specific needs.