Banking

Activate Your Data to Grow More Profitably

Keep valuable customers, grow deposits, and deepen relationships with explainable, prioritized insights your teams can act on.

Why Growth Stalls

When your bankers can’t see which customers are drifting, which products they need now, and what loyal customers look like, they are focusing in the wrong places, missing key relationships and opportunities.

What You Get

- Ranked save/grow lists by client or segment, with expected impact

- Clear drivers for bankers, talking points and action plans

- Next-best-action cues for timing, channel, and offer hints

- Easy activation into your CRM, marketing automation, and ad tools

Your teams keep working in CRM and existing marketing tools. TAZI adds intelligence on who / when / why / what, so they can act.

How Banks Get Value

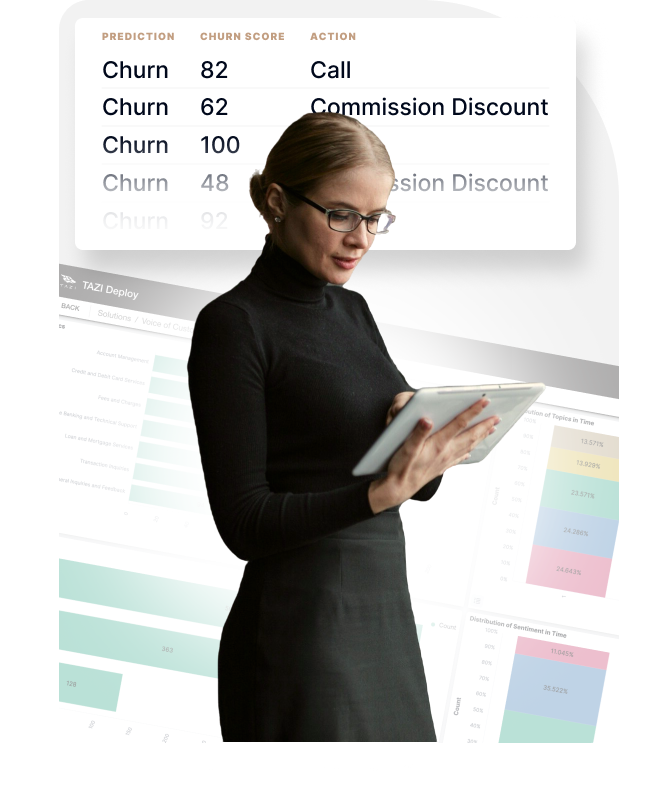

Reduced Attrition

See at-risk clients months ahead, understand the cause, and what to do to act in time. Protect core relationships and stabilize balances.

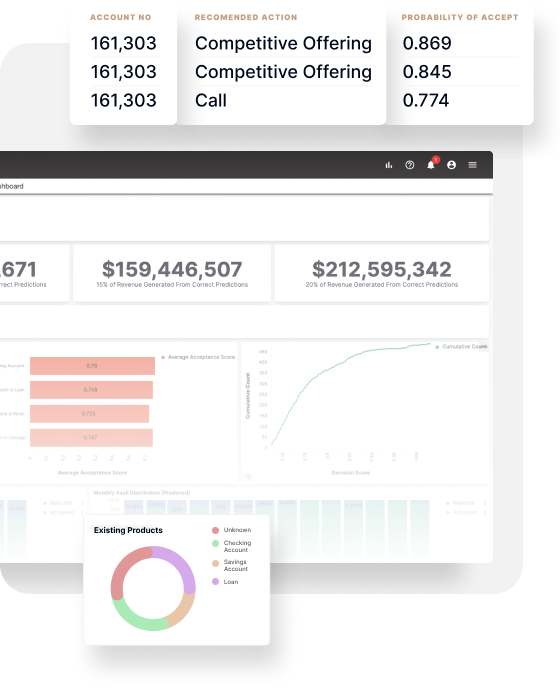

Improved Product Adoption

Predict next best products each customer needs and how to engage. Prioritize by expected lift and engage customers more efficiently, at scale.

Delighted Customers

Hyper-personalize customer engagement with information and products they need most, at each stage of their life.

How it Works

Connect essentials:

Transactions, products, engagement or support data

Predict risk and opportunity

per customer, with timing and reasons

Prioritize by expected impact, then activate at scale through sales/marketing tools

Continuously Measure & learn to improve precision and ROI

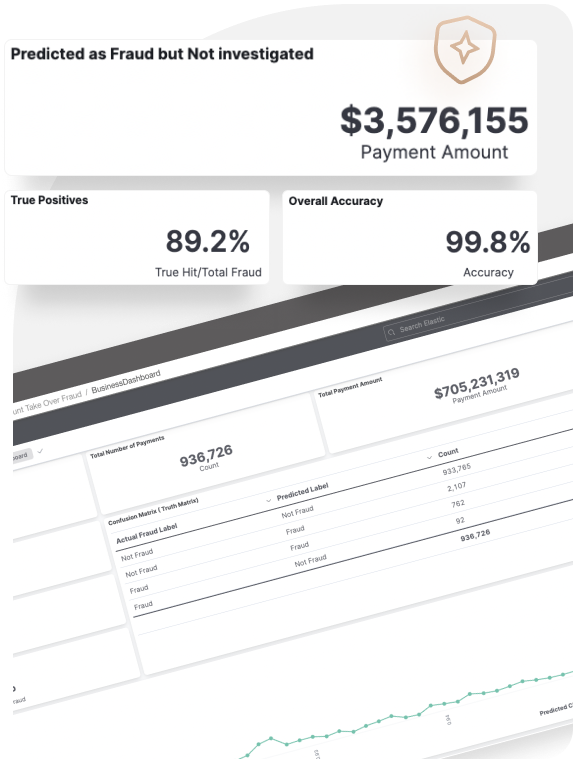

Why Banks Choose TAZI

Actionable: Relatable explanations and action plans behind every prediction

Fast: From connected data to first value in 2 weeks, then continuous auto updates

Flexible: Works with existing tools: CRM, marketing automation, and analytics

Compliant: Governance and audit needs aligned to strict financial services standards

FAQ

What data do we need to start?

You can start with transactions, products, and engagement data you have. Start lean and expand over time. No one has perfect data, but everyone has enough data to get first value.

How do advisors and branches trust the guidance?

Each recommendation shows clear drivers, the “why”, and what to do. They know how and why recommendations were made, so they can act with confidence. There are no “black boxes”.

Does this replace our CRM or marketing stack?

No. TAZI provides prioritized insights and recommendations that feed to your CRM. Bankers and marketing teams continue to work in CRM and marketing tools, but now they have additional intelligence.

Can we focus on high-value clients first?

Yes. Recommended lists are ranked by expected impact and recoverability, so effort focuses on clients that matter most.

How fast do we see results?

Many banks see early lift after the first activation cycle, in the first quarter. Track saved balances, deposit growth, response, and conversion.

Is it explainable and aligned to bank compliance needs?

Yes. Predictions and drivers are transparent and auditable, with privacy controls aligned to banking standards.

Related Content

Stop guessing and start predicting.

It's time to build a more resilient,

profitable, and client-centric future.

Discover how TAZI AI can transform your firm's client retention, share of wallet, and lead generation.