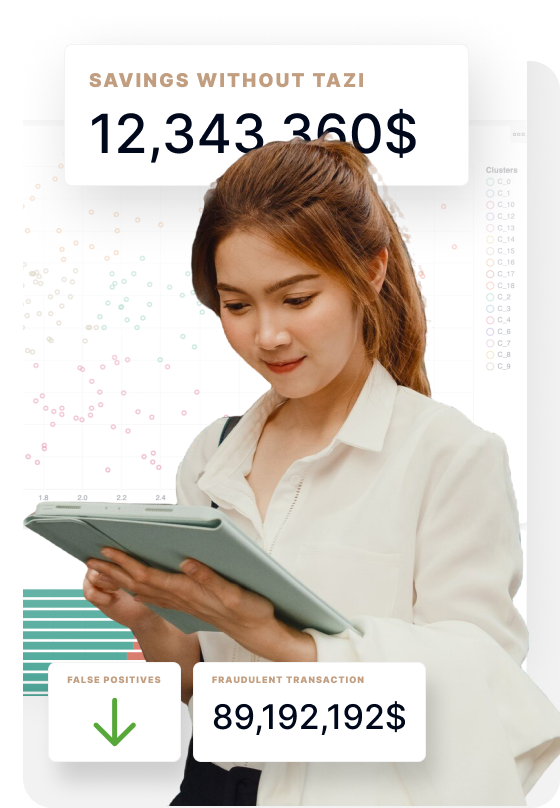

Stay ahead and adapt to real-time fraud signals

A growing suite of fraud solutions in one AI platform to better protect your customers. Connect data from multiple sources to detect fraud patterns others failed to catch.

Reduce false positives to reduce the noise and the burden on your teams while improving customer experience.

Combine internal and external data, such as customer, transactions, authentication and access, payment, communication, risk data, for accurate fraud prediction.

Real-time predictions so that you can win the constant fraud battle and stop fraud while, or even before it happens.

Automate the detection of new patterns with patented continuous self-learning ensemble of AI solutions that learn as the data changes.

Detect new categories of fraud by utilizing interconnected AI and GenAI models controlled by fraud experts.

Adjust the operating point at any time to balance your risk levels, the capacity of your investigation team, and customer experience.

Conduct expert-level investigations easier, faster, and at scale — with the help of AI explanations and data insights, without major time or engineering investment.

Real-time and batch monitoring utilizing hundreds of signals.

A growing suite of AI solutions to detect different types of fraud.

60% more signals used compared to your current AI or rules-based solution. Unearth and solve data quality problems with TAZI’s Data Profiler, business dashboards and explainable AI. Optimize operations with full AI explanations for “clearbox” AI and faster investigations.

Why TAZI

%

higher

%

lower

more

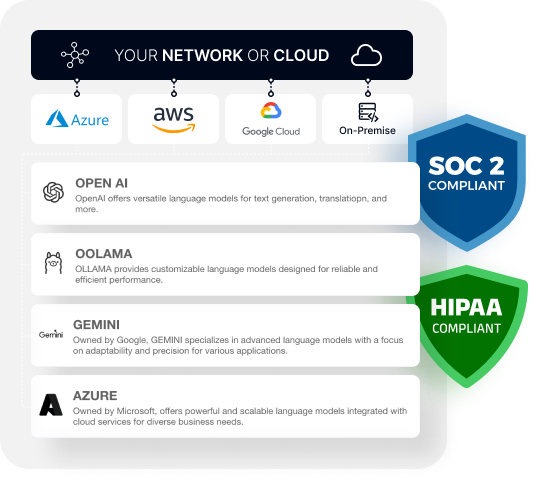

Your Client Data is Protected

- SOC2 and HIPAA Compliant

- Deployed in your environment, on-prem or cloud of your choice.

- Local (on-prem) LLM models within your firewall

- Granular user management and monitoring,

- Continuous documentation of data, AI models, performance and results

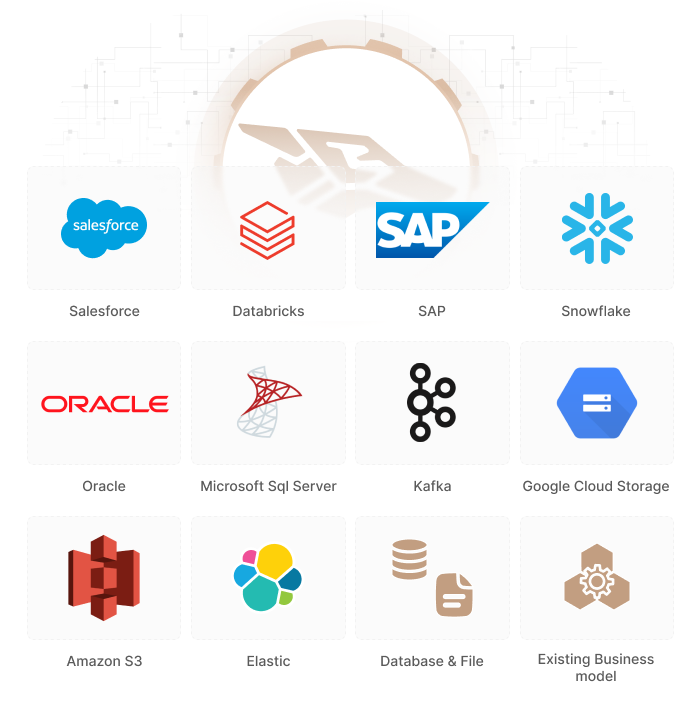

Integrated for Quick Deployment

Related Content

Experience the Future of

AI/GenAI with TAZI

✓ Showcase real-world applications and benefits.

✓ Provide a detailed platform walkthrough.

✓ Offer actionable insights for your specific needs.