Insurance

Hyper-personalized strategy in insurance to build trust and win customers

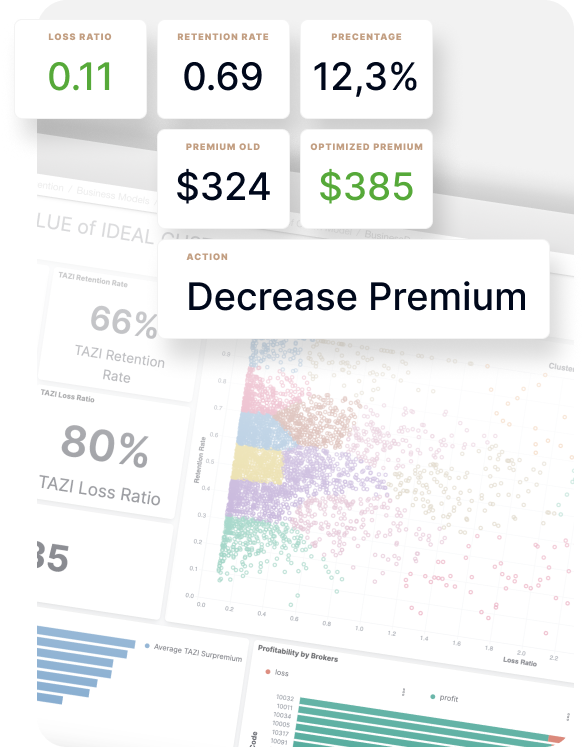

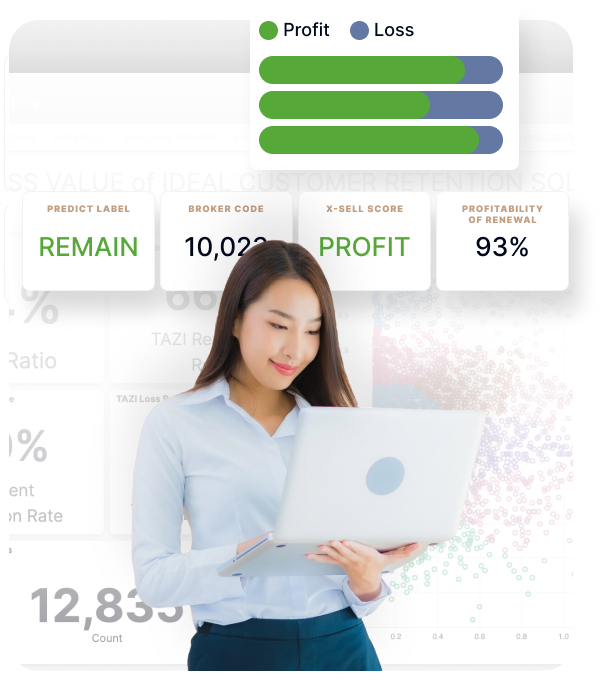

Retain Ideal Customers to Grow Profitably

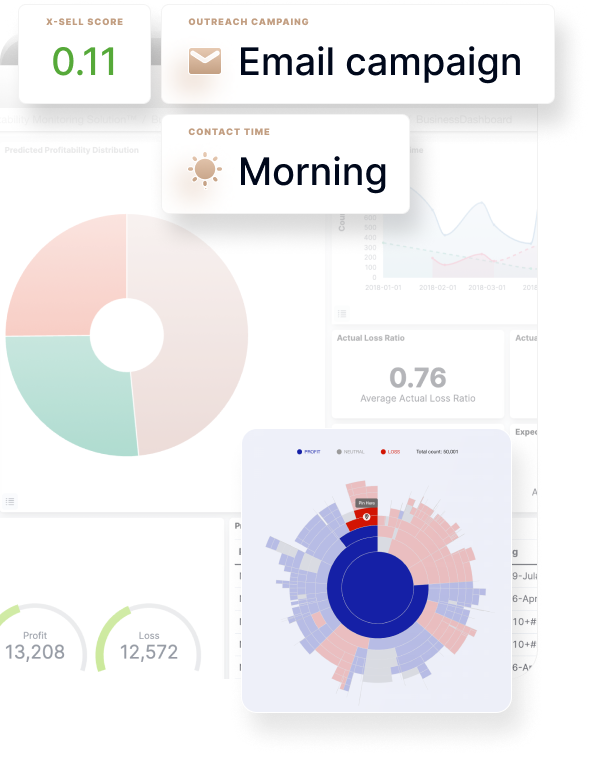

Capture Voice of Customer (VOC) from ALL channels

Increase Marketing Effectiveness with Precise Targeting

Increase Profitability through Rate Monitoring

Optimize Insurance Claims Management

Increase the efficiency of claims management requiring repetitive tasks in high volume situations such as quality assurance and fraud detection processes.

Improve insurance claims quality assurance efficiency

Optimize insurance auditors’ time by replacing random selection and static business rules with an AI solution analyzing data from many sources, utilizing 100+ factors, and generating probability scores to reduce time spent on reviewing unnecessary claims.

Increase efficiency of insurance claims fraud detection

Utilize hundreds of internal and external data points to detect fraud early. Enable fraud teams to decide on the operating point of models based on their constantly changing requirements.

Increase Efficiency Across Teams

Empower teams across your insurance company with one AI Platform housing multiple solutions. A Predictive AI platform to get a holistic understanding of your customers and improve your decisioning and customer experience.

Marketing Teams

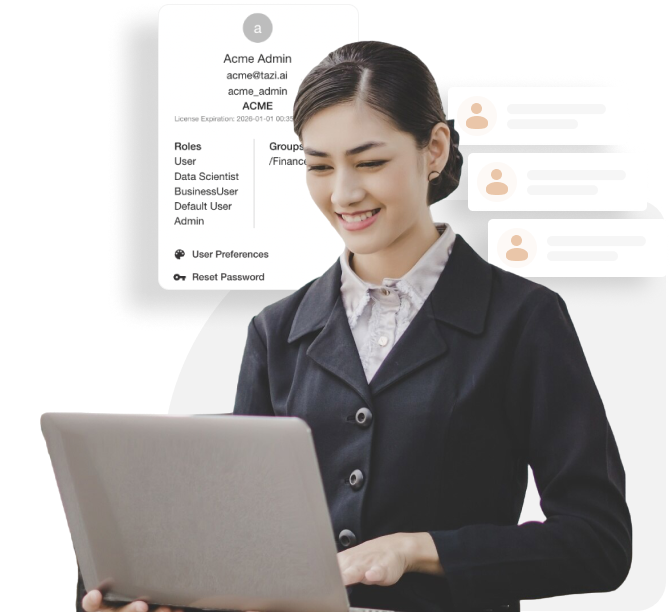

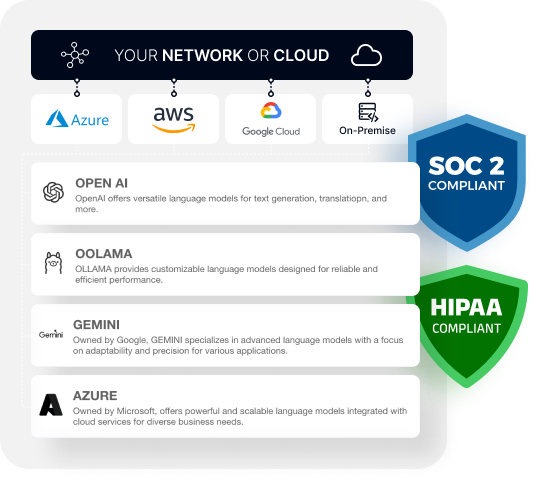

Your Client Data is Protected

- SOC2 and HIPAA Compliant

- Deployed in your environment, on-prem or cloud of your choice.

- Local (on-prem) LLM models within your firewall

- Granular user management and monitoring,

- Continuous documentation of data, AI models, performance and results

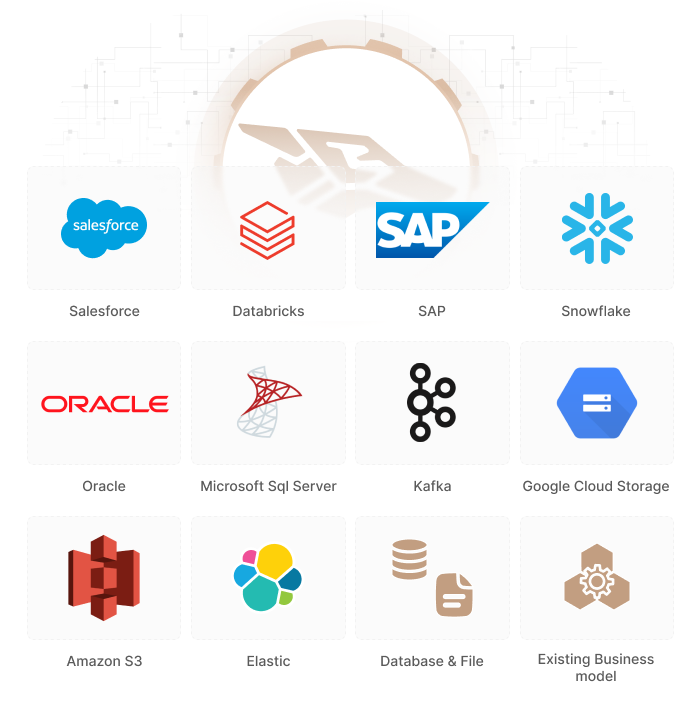

Integrated for Quick Deployment

Deployed in your own environment with more options to connect to core systems.

TAZI Solution Packages for Retention and Fraud

Related Content

Experience the Future of

AI/GenAI with TAZI

✓ Showcase real-world applications and benefits.

✓ Provide a detailed platform walkthrough.

✓ Offer actionable insights for your specific needs.